News of a temporary truce between the United States and China over punitive trade tariffs sparked a broad-based rally in US pre-market trading led by megacap technology stocks.

The group known as the “Magnificent Seven”—Amazon, Apple, Meta, Microsoft, Alphabet, Nvidia, and Tesla—rose sharply in premarket trading, with Amazon and Tesla recording the largest gains.

Amazon.com gained 8.2% while Tesla rose 8.06%, outpacing other members of the group.

Apple climbed 6%, Meta was up 5.67%, Nvidia advanced 4.33%, Alphabet added 2.53%, and Microsoft gained 2.11%.

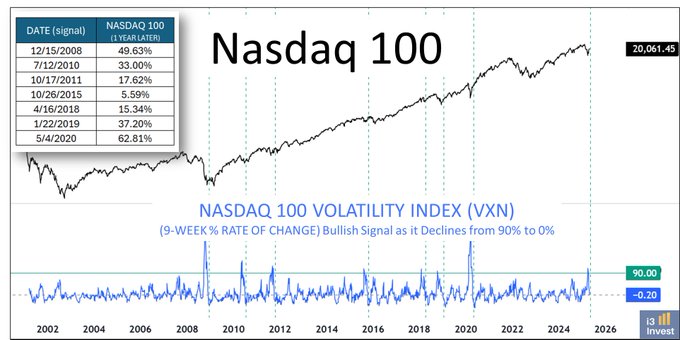

Nasdaq 100 – A Rare and Bullish Signal Based on Volatility Just Triggered (VXN 9-week % Rate of Change declined from 90% to 0%). Average 1-Year Return After Signal: +31.60%, positive 100% of the time. Is this time different?

The gains come after both Washington and Beijing agreed over the weekend to scale back tariffs for a 90-day period while they continue negotiations.

The US will lower tariffs on Chinese imports from 145% to 30%, while China will reduce reciprocal levies from 125% to 10%.

The Roundhill Magnificent Seven ETF, which offers equal exposure to each of the stocks, rose 5.6% in premarket trade.

AMZN stock jumps on Monday

Amazon led the rally as investors viewed the easing of trade tensions as particularly beneficial to the company’s business model, which is closely linked to Chinese imports and advertising.

Roughly 30% of Amazon’s inventory is sourced from China, and many of the third-party sellers on its marketplace also rely heavily on Chinese manufacturers.

Lower tariffs are expected to protect profit margins and stabilize product availability.

According to analysts at Raymond James, Chinese advertisers spent close to $8 billion on Amazon’s platform in 2024, making the region an important contributor to the company’s revenue streams.

In addition, the truce is expected to support continued investment in artificial intelligence infrastructure, a key growth area for Amazon Web Services, its cloud-computing arm.

TSLA stock jumps; company reclaims $1T valuation

Tesla stock also soared, reclaiming a market valuation above $1 trillion—a level not seen since late February.

Tesla has significant exposure to the Chinese market, both as a production hub and consumer base.

Its Shanghai Gigafactory is the company’s most productive plant globally, and China accounted for 22% of Tesla’s revenue in 2024.

Although Tesla’s supply chain in China is largely localized, mitigating the direct impact of tariffs, analysts say consumer sentiment in China has increasingly favoured domestic competitors such as BYD.

With the easing of tensions, Tesla will be hoping to recover lost ground in the Chinese market.

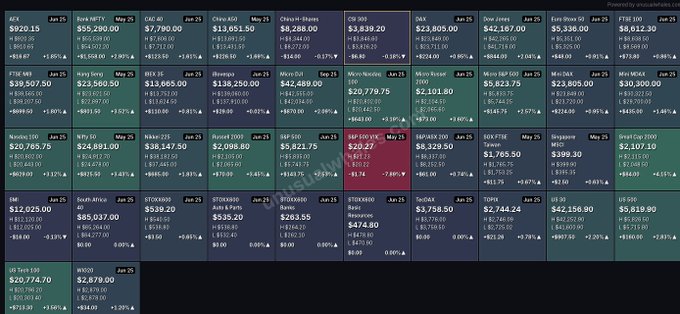

Holy. Nasdaq futures are up nearly 4%. unusualwhales.com/futures_indices

According to Citi data, Tesla’s sales in China fell 15% year-on-year in the first five weeks of Q2.

The rally also reflects investor enthusiasm for Tesla’s planned rollout of its robotaxi service, scheduled to launch in Austin, Texas, in June.

CEO Elon Musk reaffirmed the timeline during the company’s Q1 earnings call, further fuelling optimism.

The post Amazon, Tesla drive Magnificent Seven surge on US-China trade deal appeared first on Invezz